The cost of equity compensation isn't just the recognition of the grants themselves. There is also the hours finance teams spend maintaining the figures and ensuring they end up in the general ledger correctly. Every quarter or month, the same manual workflow: download reports, open Excel, map accounts, create entries, format import files, and finally upload to your ERP. It works, but it can be time-consuming, error-prone, and takes valuable time away from higher-value analysis in an often-busy period.

Today, we're excited to change that. Introducing Journal Entries — a new feature that automatically generates complete, balanced journal entries directly from Optio's financial reports, ready for import directly into your ERP system.

The Challenge: The Manual Gap Between IFRS 2 and the General Ledger

IFRS 2 requires companies to recognize the cost of share-based payments in their financial statements. For finance teams with an existing equity management software, this means using IFRS 2 reports from the system and mapping them into proper accounting entries, a process that sounds straightforward, but it is often anything but.

Here's what the typical workflow looks like today:

-

Download IFRS 2 reports from your equity management software

-

Transform it into an Excel workbook

-

Add debit and credit lines to create balanced entries

-

Map to your chart of accounts, e.g., P&L, equity, liabilities,…

-

Create an import file (or files) in the format your ERP requires, or copy the numbers by hand

-

Upload to your system (SAP, Oracle NetSuite, etc.) or paste the numbers by hand

Each step carries risk. A missed line, a wrong decimal, a transposed number, an incorrect account code, any of these can throw off your books. And when you're racing against reporting deadlines, every hour spent on manual data manipulation and correcting silly mistakes is an hour not spent on analysis, planning, or supporting business decisions.

The problem compounds as your equity programs grow. More grant types, more employees, more jurisdictions — all adding complexity to an already manual process.

Understanding Journal Entries: The Foundation of Financial Accuracy

Before we dive into the solution, let's revisit the basics: what exactly are journal entries, and why do they matter?

Think of a journal entry as the fundamental "receipt" that tells your accounting system what happened financially. Every entry captures:

- What occurred (the transaction)

- How much money (or “value”) was involved

- Which accounts should increase or decrease

Journal entries always have two sides, maintaining the fundamental accounting equation:

- Debit (Dr) – increase assets and expenses, and decrease liabilities and equity

- Credit (Cr) – increase liabilities, equity, and income, and decrease assets and expenses

Here's a practical example: When you amortize an employee's RSU grant, you need to recognize the expense in your P&L and increase equity on your balance sheet:

|

Account |

Debit (Dr) |

Credit (Cr) |

|

IFRS2 Compensation Expense |

1,000 |

|

|

Equity - Share Plan |

1,000 |

This is a journal entry: two lines, balanced (Debit = Credit), ensuring your books remain accurate.

Without proper journal entries, equity costs don't make it into your financial statements. And because equity management platforms calculate the IFRS 2 expense figures but stop there, finance teams are left to manually create the full accounting entries themselves.

That's the gap we're closing.

Introducing Journal Entries: Eliminating the Manual Excel Work

Optio clients already rely on our platform to calculate accurate IFRS 2 cost figures. Now we're taking it one step further: automatically generating complete, balanced journal entries ready for your accounting system.

Here's what this means in practice:

Balanced entries, automatically generated

Optio produces both sides of the debit/credit equation, not just the expense figure. Every entry is complete and balanced, ready to post.

Client-specific account mapping

Entries are mapped to your specific chart of accounts — P&L expense accounts, equity accounts, liability accounts — whatever structure your organization uses.

Multiple report types supported

Generate journal entries for IFRS 2 expense recognition, Social Security obligations, and other equity-related financial impacts as your needs expand.

Two output formats for different needs:

-

Optio-formatted audit file – Clean, human-readable format that's easy to review. This is your "check your work" file, allowing you and your auditors to verify exactly what's being posted and trace it back to the underlying equity data.

-

Import-ready file(s) – Structured specifically for your ERP system (e.g, SAP, Oracle NetSuite), formatted for direct upload without manual rework or reformatting.

The result? Finance teams save hours of manual work in already busy periods, reduce the risk of errors, and close their books faster with greater confidence.

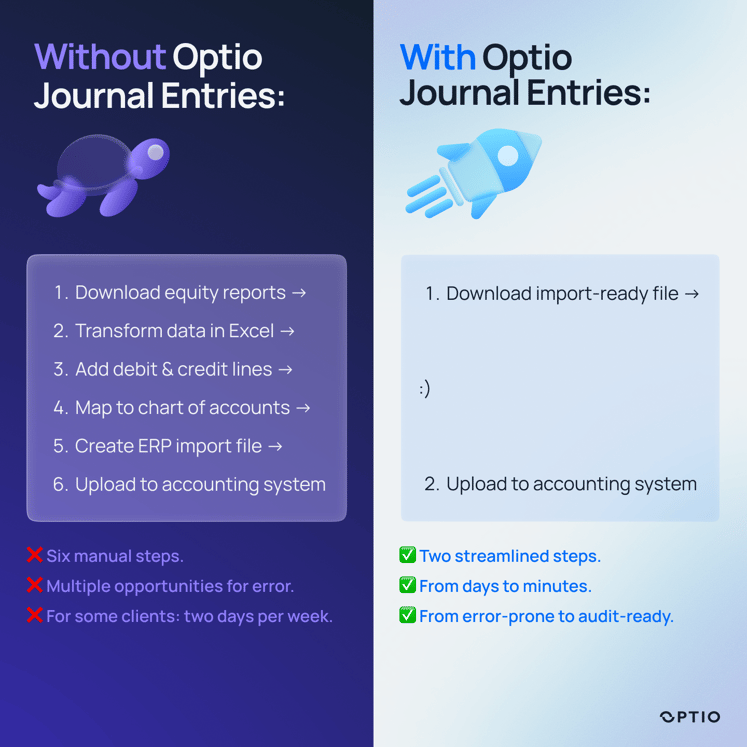

The Transformation: Before and After

Let's compare the workflows side by side:

Without Optio Journal Entries:

📥 Download equity reports

→ 📝 Transform data in Excel

→ ➕/➖ Add debit & credit lines

→ 🗂️ Map to chart of accounts

→ 📄 Create ERP import file

→ 📤 Upload to accounting system

Six manual steps. Multiple opportunities for error. For some clients: two days per week.

With Optio Journal Entries:

📥 Download import-ready file

→ 📤 Upload to accounting system

Two streamlined steps. From days to minutes. From error-prone to audit-ready.

This isn't just about saving time — though that alone is significant. It's about accuracy, auditability, and control. Every journal entry traces directly back to the underlying equity data in Optio, creating a clear audit trail from grant to general ledger.

Real-World Impact: What This Means for Your Team

The benefits ripple across the organization:

For Finance Teams:

What used to consume hours. or even days, each reporting period now takes minutes. That time can be redirected to analysis, forecasting, and supporting business decisions rather than manual data processing. Month-end and quarter-end closes become faster and less stressful.

For Controllers and CAOs:

Automated journal entries reduce compliance risk and strengthen internal controls. When entries are generated systematically from source data, the risk of transcription errors, incorrect account mapping, or reconciliation issues drops dramatically. You gain confidence in equity-related balances and audit-ready documentation.

For Growing Organizations:

As your equity programs expand — more employees, more grant types, more jurisdictions — the manual effort doesn't scale linearly; it compounds. Automation ensures that your financial reporting processes can grow with your business without proportionally increasing your team's workload.

For Your Auditors:

Clear audit trails matter. With Optio Journal Entries, auditors can trace any financial statement amount back through the journal entry to the underlying equity data, all within the Optio platform. This transparency speeds up audits and reduces back-and-forth requests for supporting documentation.

Closing the Gap Between Equity Data and Financial Statements

For too long, equity management and financial reporting have been separated by a manual gap, a time-consuming, error-prone process of transforming reports into journal entries. That gap creates inefficiency, introduces risk, and keeps finance teams focused on data processing rather than strategic work.

Journal Entries closes that gap. By automatically generating complete, balanced, import-ready journal entries from your equity data, we're eliminating the manual Excel work that slows down every reporting period.

Whether you're already an Optio client or currently using another equity management platform, the challenge is universal: getting accurate equity data into your general ledger shouldn't require days of manual work every reporting period.

If you're an Optio client, reach out to your Customer Success Manager to learn how to enable Journal Entries for your organization.

If you're exploring equity management solutions, we'd be happy to show you how Optio streamlines not just equity administration, but the entire financial reporting process.

Your equity data exists. Your accounting system needs it. Journal Entries ensures the connection between the two is fast, accurate, and audit-ready.

Want to see Journal Entries in action? Contact us to schedule a demonstration and discover how Optio can transform your equity reporting workflow.