Are you unsure how to report equity incentives according to the new guidelines for executive pay reporting?

Written by Eirik Kalkvik Stenberg

Background

On 11 December 2020, the Ministry of Business and Industry established amendments to the Public Limited Liability Companies Act §6-16a og §6-16b with the associated new regulations.The purpose is to expand the current rules on guidelines for executive pay and reporting of remuneration to senior executives.

As regards to equity-based pay it is §2 (1) point 3 og §6 (2) point 6 of the regulation that define and set requirements for different forms of equity incentives to be included in the salary report for senior employees.

Who must follow the new rules?

In short, public limited companies are required to disclose senior employee salary reports due to amendments in the Public Limited Liability Companies Act, specifically §1-1(1). Further, it is defined in the amended laws §6-16a (1), §6-16b (1) and the regulations §1 (1)that the provisions in these sections apply to companies with shares admitted to trading on a regulated market.

When must the report be ready?

The salary report must be checked by an auditor and submitted no later than the ordinary general meeting 2022 as described in §7 (2) of the regulations. This means that for most people the report for 2023 should be ready in the spring of 2024.

What must the report contain?

Section §6 of the regulation sets requirements for what the pay report must contain, and equity-based pay is described in point 6. It mandates the disclosure of allocated or offered shares, subscription rights, share options, and other share-linked remuneration pertaining to company developments or those within its group. This should include the most important conditions for utilizing the options, including the subscription price, subscription deadline and any changes to these. The information must be suitable to document whether the terms are market-oriented.

Further, §6 (3)of the regulation states that the report should be prepared in line with the European Commission's guide for reports on remuneration. Chapter 5.3 of the guide deals with share-based pay. Here we find definitions, guidelines and templates for tables that should be used in the executive pay report.

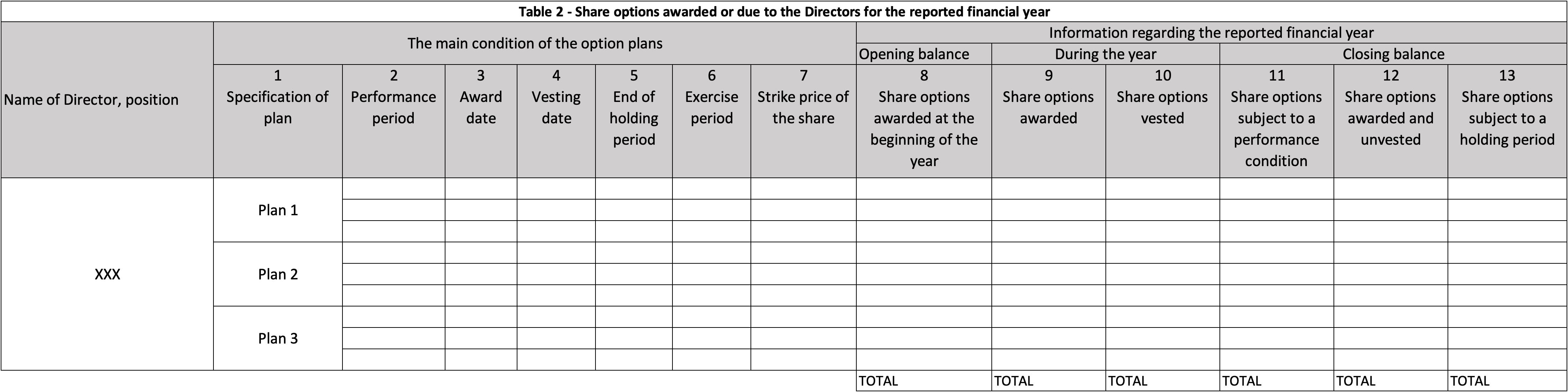

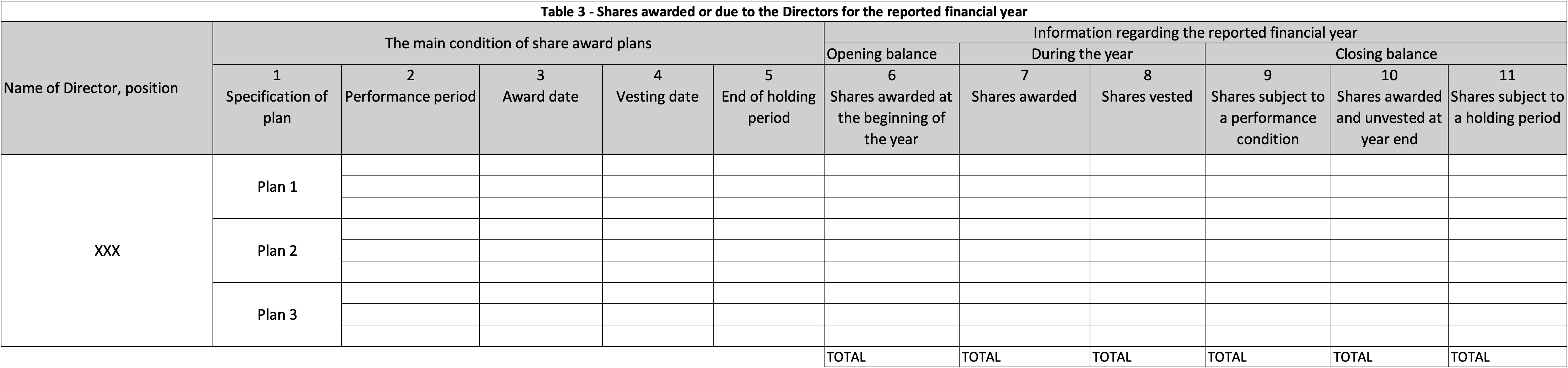

You can see the templates below:

Some of the columns are not quite straight forward to fill in as they must contain a lot of information. Here you can see what each column should contain:

| Column | Example | Description | |

| Name of Director | Ola Nordmann, CEO |

Name and position. |

|

| 1 | Specification of plan |

2021 Opsjonsplan |

The equity incentive plan's name. |

| 2 | Performance period |

01/06/2021 - 01/06/2024 |

If the plan has associated performance conditions, this column must contain the start and end date for the performance period(s) in line with the conditions of the plan (dd/mm/åååå - dd/mm/åååå). |

| 3 | Award date |

01/06/2021 |

Award date (dd/mm/åååå) |

| 4 | Vesting date |

01/06/2024) |

The award's vesting date (dd/mm/åååå) |

| 5 | End of holding period |

01/07/2025 |

If the allocation has had a restriction period beyond vesting, this column must contain the end date for this period. |

| 6 | Exercise period |

01/06/2024 - 01/06/2026 |

The redemption period of the option plan (dd/mm/åååå). |

| 7 | Strike price of the share |

11.50 |

Redemption price |

| 8 | Shares/options awarded at the beginning of the year |

0 |

Number of options or other share-based instruments held by the employee at the beginning of the year. |

| 9 | Shares/options awarded |

a. 500 b. 500 c. 6 5001 d. 5 7502 |

a. Number of instruments awarded during the year. |

| 10 | Shares/options vested |

0 |

a. Number of instruments attached during the year. |

| 11 | Shares/options subject to a performance condition |

500 |

If the plan is associated with performance conditions that have not yet been decided at the end of the year, the column must contain the number of instruments that can still be affected by the condition's outcome. |

| 12 | Shares/options awarded and unvested |

500 |

Number of instruments that have not yet fixed at the end of the year. |

| 13 | Shares/options subject to a holding period |

500 |

If the allocations have a restriction period beyond vesting and the end date of the restriction period is after the end of the year, the number of associated instruments must be stated in this column. |

- 1. 500 x 13.00 (Share price at the end of the year: 13.00)

- 2. 500 x 11.50 (Share price at allocation: 11.50)

Please note that the European Commission's guide specifies that share-based instruments other than shares and options must also be included in the salary report. This also means that instruments that are paid out in cash must be included, such as phantom shares, warrants and share appreciation rights.

Reservations

Please note that this article provides an overview of share pay in the executive pay report, and when designing the report you should clarify the content with the auditor. The auditor must approve the executive remuneration report in advance of the general meeting.

Do you like what you've read? Subscribe below and follow us on social media to stay updated on our blog posts!