Written by Kristian Piippo

What Are Performance Share Units?

Performance Share Units (PSUs) are a type of equity-based compensation awarded to employees, typically executives, that are tied to specific performance goals or milestones. Unlike stock options or restricted stock units (RSUs), PSUs are tied to performance: employees only receive shares if the company hits predefined goals, ranging from financial metrics (e.g., earnings per share) to operational targets (e.g., product launch timelines), or market-based indicators (e.g., total shareholder return relative to peers).

Think of PSUs as a team relay race. When the team reaches key company goals together, everyone involved earns shares of company stock, celebrating shared success and teamwork.

PSUs are among the most favored equity compensation tools for publicly traded firms. According to FW Cook's 2023 Top 250 Report, a significant 94% of the 250 largest U.S. companies in the S&P 500 Index utilized performance-based awards, including PSUs. Similarly, data from Optio Incentives reveals that about two-thirds of Dutch companies listed on Euronext Amsterdam incorporated PSUs into their 2023 incentive programs.

How Do PSUs Work?

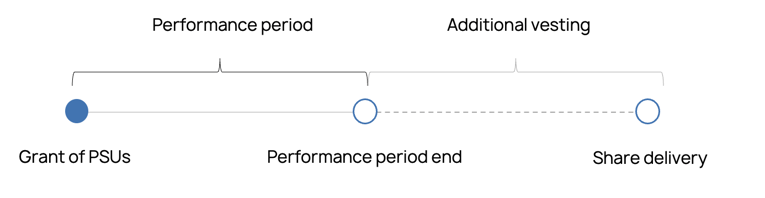

The company will grant the employees the PSUs, where the performance period will or has already started, depending on the program structure. At the performance period's end, the final calculation of performance will be made, and employees will know how many shares they have received based on the performance against the targets set out in the agreement.

Here's a simple breakdown of how PSUs typically work:

1. Set performance criteria: Determine the key performance metrics that align with the company’s strategic goals.

2. Define performance periods: Establish the time frame over which the company’s performance will be measured (typically 3-5 years), depending on the company's vision and compensation strategy.

3. Establish vesting conditions: Define the vesting schedule (e.g., cliff or graded vesting) and ensure that it incentivizes long-term retention.

4. Determine the payout structure: Decide how many shares will be awarded if the company meets specific performance targets. Define the multiplier to adjust the payout based on the degree of target achievement.

A typical structure might offer:

- 0% payout for <80% target achievement

- 50% payout at 80% threshold

- 100% payout at 100% target

- 150% maximum payout for >120% overperformance

5. Communicate the plan: Ensure employees understand how PSUs work, what the performance metrics are, and what they need to do to achieve their targets.

6. Track progress and performance: Monitor the company’s performance against the set metrics throughout the performance period. After the performance period ends and the outcome is calculated, shares are transferred to the participants for ownership. Some companies also choose to operate with an additional vesting period after the performance period to increase the focus on long-term value creation and retention.

Below is a timeline illustrating a company's PSU grant process, including the performance period and subsequent vesting before share delivery.

Types of Performance Goals for PSUs

The performance goals are generally divided into two categories:

1. Internal company target (also called non-market target)

These are goals based on the company’s internal financial or operational performance. Common examples include:

Financial Metrics:

- Revenue growth

- Profitability (e.g., net income, EBIT, EBITDA)

- Earnings per share (EPS)

- Return on Invested Capital (ROIC)

- Return on Equity (ROE)

Operational Metrics:

- Customer satisfaction

- Product development milestones

- Employee engagement or retention

- Innovation indices

Sustainability and ESG Metrics:

- Environmental targets (e.g., carbon emissions reduction)

- Social or governance-related goals (e.g., diversity, safety)

Large companies are increasingly linking Environmental, Social, and Governance (ESG) goals as part of their performance metrics for executive equity compensation. According to a 2023 report by KPMG, over 80% of large EU companies now incorporate ESG metrics into executive compensation.

2. Target based on the company’s share price performance (also called market-based goals)

These goals are linked to the company’s share price performance, either on an absolute or relative basis. Common market-based goals include:

- Total Shareholder Return (TSR): Achieving a certain TSR over the performance period.

- Share Price Targets: Reaching a specific share price by a certain date.

- Relative Performance: Outperforming competitors or an industry benchmark in terms of share price appreciation.

Many PSU plans combine internal and market-based metrics for comprehensive performance evaluation, for instance, requiring both minimum EPS growth and relative TSR targets to achieve maximum payout. These metrics can be adjusted as company strategy or market conditions evolve, keeping PSU awards relevant and fair. The selected metrics and their weightings clearly communicate the company's strategic priorities.

Why do companies use PSUs?

Aligning Employee and Corporate Goals

A key advantage of PSUs is that they allow companies to set precise, meaningful goals aligned closely with stakeholder priorities, including investors, the Board, and management.

PSUs encourage a performance-based culture by rewarding results rather than tenure. By linking employee rewards directly to business outcomes, PSUs align employee interests with shareholders', promoting shared growth and accountability.

Enhancing Shareholder Value

If shareholder return is the focus, the PSUs can be structured based on that. If there is a greater emphasis on value creation through business development, for example, in a volatile or down-trending stock market and/or macro environment, PSUs can be structured to focus on internal company goals. This is done to compensate employees for their continued value creation despite a challenging macro environment that negatively affects the stock price.

A Balanced Form of Compensation

In addition, PSUs are considered fair as they reward employees only when goals are met, ensuring payouts reflect target achievements. They offer financial flexibility by avoiding immediate cash outlays, allowing companies to focus resources on strategic priorities while still incentivizing employees.

To further underline how PSUs can be structured as a balanced form of compensation, consider this example:

The stock market is in a downturn, and overall predictions for the stock in the coming years are rather weak, with a recession looming over the global economy. The company knows that it must continue to compensate its employees in a competitive way to motivate and retain them, even if the share price appreciation is not as strong as in the past. An increase in cash compensation is off the table as the company is preserving its cash base. Options can prove to be difficult, as they are solely dependent on a share price increase.

However, the company can choose to use PSUs, even with various performance targets. For example, they can use one internal metric that will be a good proxy for the company’s long-term value creation, such as return on invested capital (ROIC), and even combine this with a market-based target. In this case, the market-based target should not be based on the company’s share reaching a certain target, given the poor outlook for the stock market in general, but maybe rather be based on how the company performs versus its peer group. This way, the company has a focus on its internal value drivers while also focusing on a certain share price performance.

Challenges and Risks of PSUs

While PSUs offer compelling alignment between executive compensation and company performance, they present several significant challenges for organizations to navigate.

Complexity and Administrative Burden

PSUs are complex to design, manage, and communicate, increasing the administrative burden and risk of errors.

Uncertain Payouts

PSU payouts depend heavily on achieving predetermined performance metrics, which can be difficult to set fairly and may be affected by external market volatility or unforeseen events.

Potential for Unintended Behaviors

Poorly selected performance metrics can inadvertently incentivize short-term thinking, encourage gaming of the system, or lead to excessive risk-taking rather than sustainable value creation.

Dilution and Associated Costs

Awarding shares through PSUs may dilute existing shareholders' equity and become costly if performance exceeds expectations significantly, necessitating careful oversight and planning.

How PSUs Are Taxed in Different Markets

PSUs are taxed differently depending on where you work. In the United States, no taxes are due at grant. When PSUs vest, the fair market value of the shares is taxed as ordinary income, and employers withhold income and payroll taxes. When you sell the shares, any gains are taxed as capital gains—short-term or long-term, depending on how long you hold them.

In European markets, the approach is similar but varies by country. There's generally no tax on grants. At vesting, the value of the shares is taxed as employment income and often includes social security contributions. At sale, capital gains tax applies to any increase in value after vesting. For example, the UK taxes vested shares as income and applies capital gains tax on sale. Germany, Italy, and the Nordics follow similar patterns, taxing at vesting and again at sale. In Switzerland, vested shares are taxed as income, but capital gains are often exempt unless trading is deemed professional.

Example:

You receive 1,500 PSUs. They vest when the stock is worth €40 per share.

- At Vesting: You recognize €60,000 in taxable income (1,500 × €40). Taxes are withheld based on local law.

- At Sale: You sell later at €55 per share. The €22,500 gain (1,500 × (€55 - €40)) is subject to capital gains tax, depending on your holding period and country.

Employers usually handle tax withholding by selling a portion of the shares to cover obligations. The specific rates and rules depend on local tax laws, so personal tax advice is recommended.

Differences Between PSUs and Other Equity-based Incentives

PSUs require the fulfillment of specific performance goals for vesting, unlike stock options and RSUs, which may vest over time or based on other conditions.

PSUs vs. Stock Options

One of the main differences between stock options and PSUs is that PSUs are tied to specific performance goals, rather than just the passage of time. This means that the recipients of PSUs must meet certain targets for the units to vest and be converted into shares of company stock. PSUs have no strike price for employees to pay, meaning that there is no capital outlay for the employees.

Additionally, for employers, PSUs can be more resource-intensive than options, as they often involve performance metrics that may require more administrative resources.

PSUs vs. Restricted Stock Units (RSUs)

PSUs are typically contingent upon the achievement of specific performance benchmarks, whereas RSUs are usually tied to a time-based vesting period without performance metrics.

PSUs vs RSUs - Key differences

Common questions about performance share units

What happens to my performance stock when I leave my company?

If you leave your company before your PSUs vest, you typically forfeit the shares. Specific details may vary, so always review your company's PSU agreement.

How do you calculate the value of performance share units?

The value of PSUs is calculated based on the fair market value (FMV) of the company's stock at the time of vesting. Back to our previous example, if 1,500 PSUs vest when the share price is €40, their FMV at vesting is €60,000 (1,500 × €40). After vesting, any increase in the share price becomes a capital gain realized upon selling the shares.

When do performance shares vest?

The vesting of performance shares depends on the terms of your company's program. Typically, it can range from 3 to 5 years, provided that specific performance targets have been met.

Conclusion

Performance Share Units (PSUs) offer companies a flexible, strategic way to align employee compensation with specific business objectives and performance outcomes. When thoughtfully designed, PSUs encourage sustainable, long-term growth and align employee interests closely with those of shareholders and stakeholders.

Ready to Optimize Your PSU Program?

Discover how Optio Incentives software streamlines PSU plan management - saving you time, reducing complexity, and ensuring alignment with your strategic goals.

Contact us today and start maximizing the impact of your performance-based compensation!