What is a Cap Table?

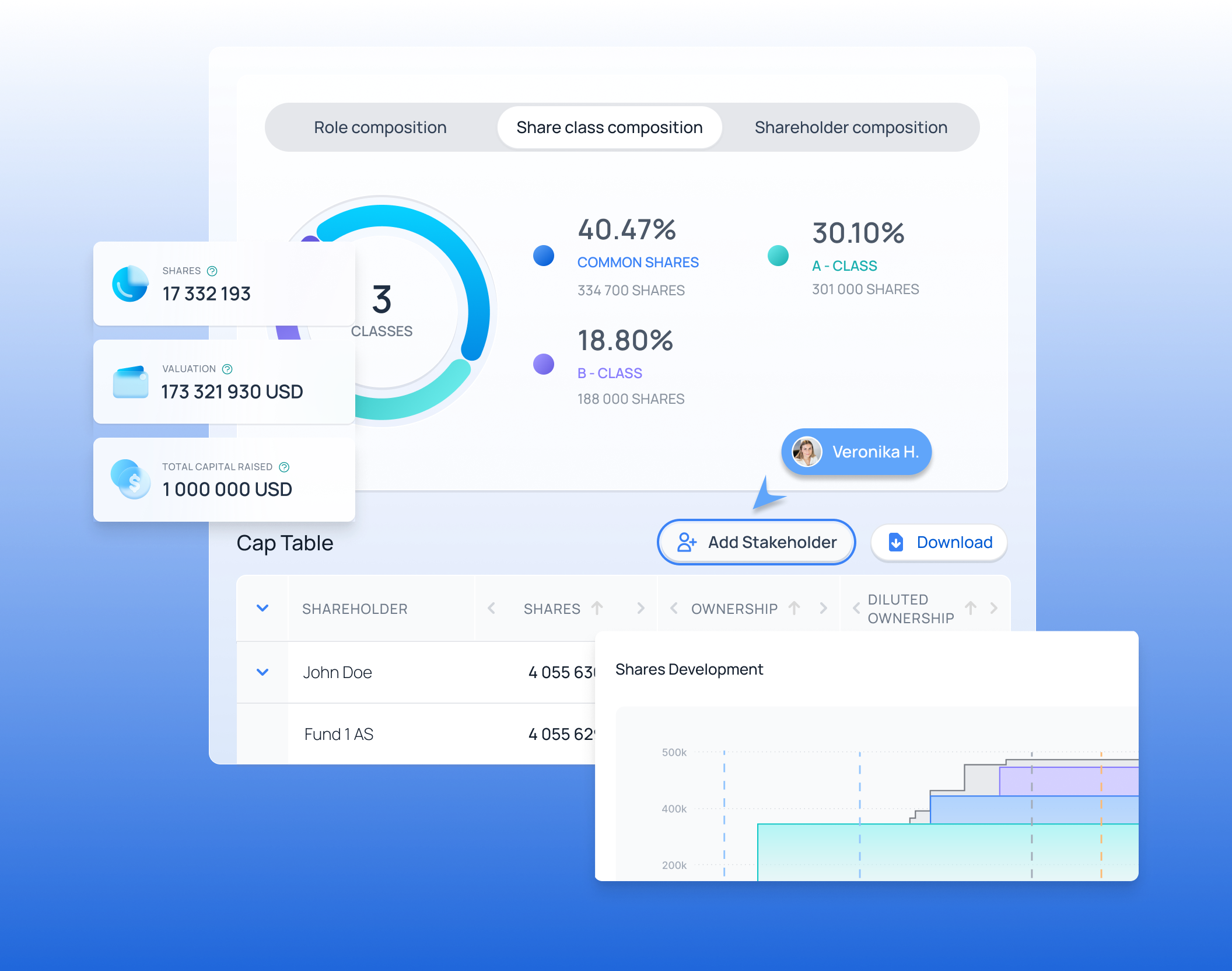

A cap table, short for capitalization table, is a record that outlines a company's ownership structure and the distribution of equity. It provides a transparent overview of shares, ownership percentages, and shareholder information, offering clarity and transparency in equity ownership. In the early stages, a basic cap table typically includes the founders and their respective ownership percentages. However, as a company engages in fundraising and attracts investors, the cap table becomes more intricate, encompassing investor names, the number of shares they possess, share prices, and their overall ownership percentage in the company. Additionally, when companies grant equity instruments to employees as incentives, it impacts the future cap table. These shares, reserved for employees, should appear as potential dilution on cap tables, even if they aren't reflected in the current ownership - this is referred to as the dilutive effect and ownership in your company's Cap Table.

What is the importance of a Cap Table?

Cap tables are indispensable for several reasons:

Transparency and Clarity: They provide a clear snapshot of equity ownership, reflecting the company's ownership structure accurately.

Decision-Making Tool: When raising funds, an overview of the cap table is crucial for informed decision-making by both the company and investors.

Compliance: Regulatory authorities and auditors often require companies to present their cap tables annually, ensuring adherence to legal standards and facilitating the process of capital rounds and ownership changes.

Difference between pre-money and post-money cap table

A pre-money cap table delineates the ownership of a company prior to receiving external financing or issuing new equity. It illustrates the distribution of the company's equity just before the advent of an investment. In contrast, a post-money cap table reveals the company’s ownership structure following an investment round, showcasing how equity is dispersed after new capital has been infused.

Learn more about our feature, Cap Table Management.

Cap tables can be very complex, especially for companies that have raised multiple rounds of funding or have issued a range of different securities. As such, it is important to keep them up-to-date and accurate, as they form the basis for important decisions such as equity financing, mergers and acquisitions, and IPOs.

A Cap Table can be challenging to handle for companies:

- with different preference shares – liquidation preferences (seniority, participating rights, etc.)

- with regular transactions

- having a high number of investors

- with investors located in different jurisdictions

- with a high number of securities (multiple convertible rounds, equity instruments, etc.)

.png)

.png)

Let's chat about Cap Table

Book a quick demo and we are happy to answer your questions

How to manage a Cap Table?

Managing a cap table is a critical task that can have a significant impact on the success of your company and the relationships with your stakeholders. It's essential to approach this process with diligence and care. Effective cap table management is crucial to avoid common pitfalls:

- Regular Updates: Ensure your cap table is always up to date, reflecting the latest transactions and ownership structures.

- Legal Compliance: Adhere to existing agreements and legal requirements, avoiding mistakes that could affect stock allocations and shareholder rights.

- Clear Communication: Maintain open lines of communication with shareholders about their ownership status and any significant changes.

- Avoid Manual Management: Relying solely on spreadsheets or manual methods increases the risk of errors and inefficiencies.

The Solution: Spreadsheets or Cap Table management software?

A Cap Table can be managed using conventional tools like Excel and Google Sheets, or through more specialized Cap Table management software. However, it's essential to understand the key distinctions between a standard spreadsheet and specialized software and the reasons why early adoption of the latter might be advantageous.

What’s wrong with using spreadsheet to manage your cap table?

- Rounding errors

- Spreadsheet formula errors

- Human errors like manual errors, missing to save updates and version control

- Missing information

- Discrepancies

- Manual process of communicating to relevant stakeholders like lack of automation for example granting and exercising options

- Time consuming process

Therefore, it is advisable to select the right cap table management software to streamline the process. Choosing Optio Incentives' reliable cap table management software brings several benefits:

- Data Protection: Secure your sensitive data with robust protection mechanisms.

- Access Control: Implement access controls to safeguard information.

- Regulatory Compliance: Stay compliant with guided setup and ongoing support.

- Growth Management: Support your company’s growth with scalable solutions designed for ease of use.

- Simulation Capabilities: Engage in effective scenario planning with simulation features, aiding strategic decision-making.

- Stakeholder Communication: Facilitate seamless communication with stakeholders through automated processes.

- Plug-and-Play: Easily integrate with various equity instruments for a smoother experience.

.png)

.png)

With our user-friendly, self-service platform, manage your digital cap table effortlessly and gain detailed insights.

Cap tables are more than just administrative tools, they are strategic assets that demand careful attention and management. By understanding their importance and utilizing digital tools, private companies can ensure accurate, compliant, and efficient cap table management, paving the way for successful fundraising and growth.

To learn more, read about our Cap Table and its features here.

Subscribe below and follow us on social media to stay updated with our insightful blog posts. We're here to help you navigate the world of equity incentives and drive your company's success!